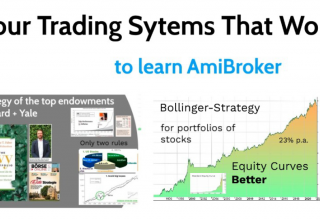

Bring your Systematic Trading to the next level – From zero idea to the AmiBroker user who implements strategies of the professionals.

Backtesting your trading ideas is not rocket science. Learn from the author and trader Urban Jaekle step by step- from absolute basics until the application of trading systems which work on a portfolio of hundreds of stocks. Every example is explained with detailed learning videos- altogether video material of more than 6 hours. See the content list below.

To make orientation easy and learning efficient, all topics are shown below the video with time stamp. In the end also the advanced trader and AmiBroker user will get something which he can use to improve his trading results.

Course Curriculum

- Chapter 1: Get market data (Users who already have data can skip this chapter)

- Chapter 2: Start with AmiBroker: In 40 Minutes to useful results

- Chapter 3: Scan and explore your data

- SCAN which stocks have new highs and new lows, end of day and realtime

- SCAN which stocks produce MACD buy or sell signals, realtime

- Control questions about lession 3.1 and 3.2

- EXPLORE = ADVANCED SCAN – three small examples

- Create a Correlation Table with an exploration

- Control questions about lession 3.3 and 3.4

- Code for lesson 3.1

- Code for lesson 3.2

- Codes for lesson 3.3

- Code for lesson 3.4

- Chapter 4: Trading systems for single markets

- Two simple examples of Trading Systems to start with: BuyAndHold and Moving average Crossover with Optimization

- Control questions about lession 4.1

- Beginning of Month System – from basics up to Monte Carlo Analysis and Walk Forward Testing – Idea, Code, Settings, Backtest, Exploration

- Beginning of Month System – Reproduce Results from my book “Trading Systems”

- Control questions about lession 4.2 and 4.3

- Walk Forward Analysis (vs normal optimization)

- Control questions about lession 4.4

- Monte Carlo Analysis on Beginning of Month system- easy to use!

- Control questions about lession 4.5

- Codes for lesson 4.1

- Code for lessons 4.2 – 4.5

- Chapter 5: Trading a portfolio of stocks

- Portfolio tests with the Bollinger system- overview and out of sample trades

- Control questions about lession 5.1

- Survivorship bias in portfolio tests

- Control questions about lession 5.2

- Bollinger System – Reproduce results from my book “Trading Systems”

- Control questions about lession 5.3

- Code for chapter 5

- Monte Carlo Analysis on a portfolio of S&P500 and Nasdaq100 stocks